THE FED LOSES CONTROL OF THE REPO RATE, DOES A HAWKISH CUT, AND WILL HOLD IN DECEMBER

Will the basis trade unwind? Is “Non-QE QE” coming?

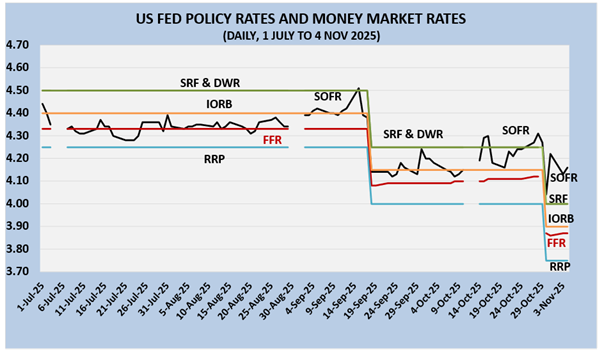

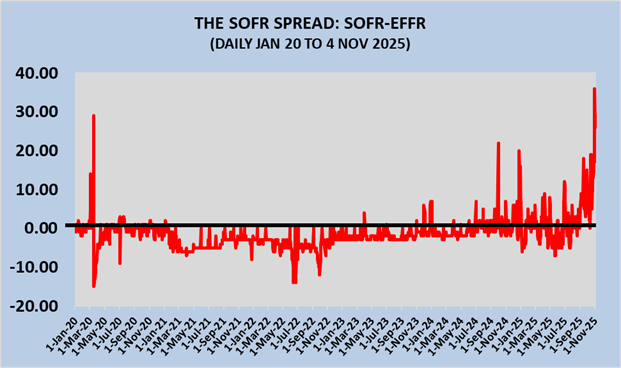

In my previous post (see here), I explained in detail how the lack of liquidity in the money market (short-term maturities, particularly 24h) was increasing the overnight repo rate (SOFR) to levels that could trigger the unwind of the basis trade, with hedge selling Treasuries spot, putting pressure on the most important financial market in the world. The FED is supposed to keep control of SOFR by offering to do repos (lending against Treasury debt securities) at a rate it sets (SRF, the Standing Repo Facility rate), thereby putting a ceiling on the secured market for SOFR.

(SUBSCRIBE FOR FREE)

Two rates determine the overnight market price of one dollar: the Fed Funds Rate (FFR) and the Secured Overnight Financing Rate (SOFR). The first is unsecured in the sense that it results from the activity of participant financial institutions in lending/borrowing one dollar for 24 hours without any collateral or guarantee. Transactions are based on trust among the participating institutions, and in the past, this was the primary form of short-term lending/borrowing among banks in what was then called the Interbank Market. However, trust tends to disappear with crises and liquidity-stressful episodes, and since the 1980s, a secured form of lending/borrowing started to grow, using repurchasing agreements (repos) whereby one institution lends cash to another with the security of a pledge of securities, which the lender takes possession of in case the cash is not repaid.

Especially after the 2007/8 crisis, repos became the dominant component of institutions’ short-term lending and borrowing, while unsecured lending and borrowing declined sharply. The repo market in dollars, which is mainly for 24-hour maturities, reached a size of 12 trillion USD and is the crucial underbelly of the international monetary system. It substituted the old correspondent banking network with its trust-based transactions. Repos are done using mostly US Treasuries worldwide and are important for the demand of US debt securities. The basis trade is mainly done by hedge funds, as a sort of “arbitrage” between Treasuries spot and futures prices, which is valued at about $2 trillion and also depends on repo financing (see my previous post here).

The repo market is used by institutions to manage their daily liquidity positions ─ to meet reserve requirements, settle trades, invest temporarily idle cash and enhance leverage. The market is concentrated in overnight maturities because it’s cheaper and limits mark-to-market volatility exposures. What makes overnight repos a dangerous trigger of liquidity crises is their use to enhance leverage, i.e., to fund long-term assets cheaply by relying on the overnight instrument being continuously renewed or rolled over every day. Investment banks and other non-bank institutions used the practice to fund their positions in mortgage-backed securities (some subprime!) when the 2007/8 arrived, leading to no renewals and/or higher repos rates. The 2007/ 8 crisis was a “run on repo”, as Gary Gorton famously said. Hedge funds also use overnight repos to fund their basis trade activity. The March 2020 “dash for cash” crisis saw the repo rate soar, and suddenly hedge funds, instead of buying Treasuries spot, started selling them. Repos are, therefore, liquidity providers in good times and huge amplifiers of liquidity contraction in times of stress. The players in that market take the profits in good times and rely on the FED to rescue them in liquidity-stressful situations by intervening heavily to supply liquidity (September 2019, March 2020).. I think there are regulatory and supervisory shortcomings in unconditionally allowing the use of overnight repos to enhance leverage and fund long-term asset positions. In particular, the re-use and rehypothecation of the same underlying securities creates a collateral multiplier that amplifies by several times the liquidity creation/destruction by overnight repos ( e.g. seven times in the case of US Treasuries, see Infante et al , 2020 [i] ).

As an aside, one should be aware that there are 20 Sovereigns in the Euro Area issuing debt, implying that there is no single overnight repo rate in euros, as it depends on the quality of the underlying securities. In a few small countries, there is no repo market to speak of. Consequently, the problems mentioned in relation to the sizable US markets hardly exist in the Euro Area.

Regarding the FED, the repo market crises of September 2019 and March 2020, led to reforms to take seriously the existence of two overnight rates as the price of money. Ideally, the FFR and the SOFR should not be too far apart, and the SOFR should not be allowed to reach too high a level that could endanger the basis trade and/or the Treasury market. In 2021, the FED created the Standing Repo Facility (SRF), with a rate set by the FED, and since then has been equal to the Discount Window rate. The FED offers to do repos against Treasuries, which should put a ceiling on the repo market rate (SOFR) if the participants in both markets were the same. In reality, they are not, as access to the SRF is limited only to Primary Dealers and some Banks. Therefore, the SOFR can exceed the SRF rate and has done so several times since September and particularly continuously since last week, as shown in the following chart:

The repo rate exceeding the SRF rate means the FED lost control of the SOFR, despite the use of the Standing Repo Facility reaching around 100 billion in the past few days. It also implies the spread of the SOFR over the FFR has been increasing, ominously to levels similar to March 2020, as shown below

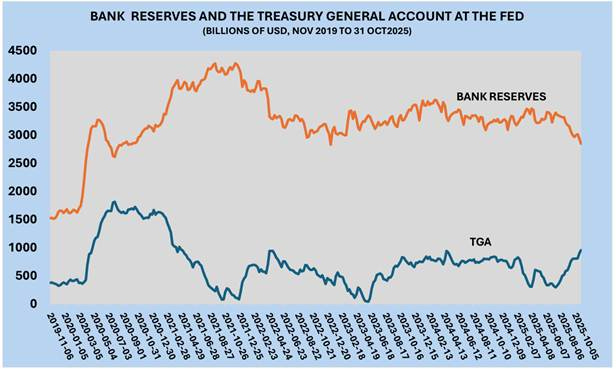

The lack of liquidity in the money market is due, firstly, to the shrinking of bank reserves at the Fed, which is a result of the policy of reducing the balance sheet (QT or Quantitative Tightening); secondly, to the increase in the Treasury’s account at the FED (TGA, Treasury General Account). The Government shutdown is contributing to the latter because taxes are paid into the account, while expenditures are not being made. The reduction of bank reserves to $2,845 billion is below 10% of GDP and is considered insufficient.

A significant liquidity crisis this time should be unlikely

Given the liquidity shortage, the SRF has been clearly insufficient to control the SOFR, and the FED must find another way to inject liquidity into the market. In my previous post, I wrote that the FED should.

a) End QT immediately, stopping to shrink the balance sheet.

b) In case the Standard Repo Facility (SRF) is shunned by financial institutions and does not stabilise the repo rate, be prepared to purchase T-Bills as in 2019

c) Keep the floor system of monetary policy implementation with “abundant reserves” as it said in the 2019 decision defining the future of the floor system.

Last week, the FED indeed announced the end of QT in December and the reinvestment of future principal payments on maturing Treasuries, so that the size remains constant in absolute terms. Still, that will not increase the balance sheet or banks´ reserves. More will have to be done. Jay Powell did say that the balance sheet will have to increase in the future in proportion to the increase in nominal GDP and that the FED will maintain the “ample reserves” regime it decided in 2019. With this policy, it is quite easy for the FED to stabilise liquidity and the repo rate, as large-scale intervention would not be necessary to achieve that. The fact that it has not done it so far can only be the result of divergences within the Board regarding the balance sheet size and the adoption of a policy that could be characterised as QE. Secretary Bessent and some FED Board members oppose it for ideological reasons. In reality, purchasing short-term Government paper is not QE, as this policy tool was introduced in 2008 as a monetary policy instrument to reduce medium-term market yields, which is quite different from a pure liquidity management policy. It is not QE, but in 2019, the FED had difficulty convincing the market and media of that, as the policy was then, ironically, called “non-QE QE”. Nevertheless, I believe that if SOFR remains too high, the Fed will have to take whatever steps are necessary to avoid the dangerous unwind of the basis trade. A significant liquidity crisis this time should be unlikely.

A DIVIDED FED IN A DIVIDED K-ECONOMY

Besides the money market liquidity problem, from the perspective of monetary policy goals, the FED faces a challenging assessment of the US economy, divided between inflation and unemployment risks and between Wall Street and Main Street. A k-economy indeed, with a buoyant tech sector and a lingering manufacturing and construction industries, with the 10% highest income responsible for 49% of consumer spending, according to Moody´s chief economist, and a struggling sizable population segment.

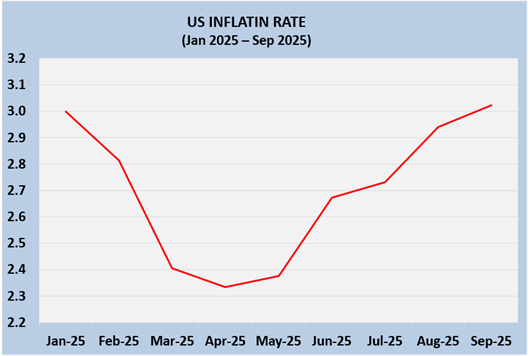

Inflation had continued to slow in early 2025, but since April 2nd, the day of the tariffs madness, it has been rising above the FED´s target (see chart below). Unprecedently, though, the FED decided to cut the policy rate by 25 basis points. Powell, in the subsequent press conference, showed that the cut had been sort of a reluctant decision by adopting a hawkish tone regarding future rate movements. A cut in December was declared “not a foregone conclusion, far from it”.

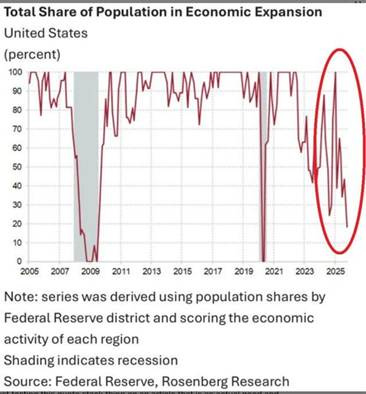

The reasons for the cut were related to employment developments, as the number of jobs has been decelerating overall and even declining in manufacturing and construction, contrary to Trump´s promises. Without official data due to the most extended Government shutdown, the private-sector ADP showed declining hiring over the previous two months but indicated a 42000 increase in October in a somewhat puzzling print. The private Conference Board, in its latest leading indicators publication, identified a recession starting in August, and Rosenberg Research extracted from the FED beige books that more than 80% of the US population is in recession (the chart below, published in Substack by @globalmarketsInvestor, shows the segment in expansion). Tej Parikh at the FT& published that one-third of the States of the Union were in recession in September.

Suddenly, the US k-economy looks as heterogeneous as the Euro Area!!.

(SUBSCRIBE FOR FREE)

Without official macro data for September and October, the likely continuation of the shutdown will make it virtually impossible to interpret the US k-economy situation. The stock market is also a divided, separate realm, with the magnificent seven being responsible for most of the buoyancy, while the rest climb much more slowly than the European stocks. I believe that all the mentioned uncertainty will supply additional arguments for the FED to stay on hold in December. It will be the correct decision.

[i] See Infante,S, Press,C, and Zack Saravay (2020) “Understanding Collateral Re-use in the US Financial System” American Economic Review, May, vol. 110: 482–486

Fascinating, as is the following FED note on keeping track of the Basis Trade

https://organon.substack.com/p/the-cross-border-trail-of-the-treasury

Excellent Vitor, such a good description of the forces at play in the interbank market. One argument for allowing SOFR to trade higher is to eliminate the incentives for many of the non-interbank function-related demand for repo. The Fed has a commitment to provide ample liquidity to the banks for ordinary interbank purposes, but it does not need to ensure ample liquidity for massive spread trading by risk-taking non-banks. This is beyond the original scope of the Fed mandate. Ensuring HFs have access to stable overnight funding is an unnecessary responsibility for the Fed to take on.